What is Life Insurance?

Life insurance is a contract between an individual (the policyholder) and an insurance company, where the insurer agrees to pay a specified sum of money (the “death benefit”) to the beneficiary upon the policyholder’s death. In exchange, the policyholder pays regular premiums. The primary purpose of life insurance is to provide financial security for the policyholder’s family or dependents in the event of their death.

Why Life Insurance?

- Financial Protection: It ensures that loved ones have a financial cushion.

- Debt Coverage: It can help pay off debts like mortgages or loans.

- Future Planning: Helps in planning for events like a child’s education or retirement.

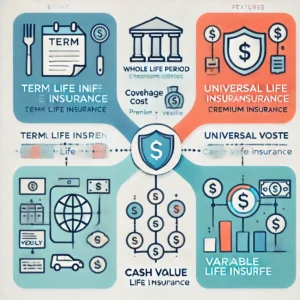

Types of Life Insurance

There are several types of life insurance policies, each designed to meet different financial needs and goals.

1. Term Life Insurance

- Definition: Provides coverage for a specific term or period (e.g., 10, 20, or 30 years).

- Premiums: Typically lower compared to other types of life insurance.

- Benefits: The death benefit is paid only if the policyholder dies during the term.

- Best For: People looking for affordable, temporary coverage (e.g., covering debts or income replacement).

Merits:

- Low premium cost.

- Flexible terms.

Demerits:

- No payout if the policyholder outlives the term.

- No cash value accumulation.

2. Whole Life Insurance

- Definition: Offers coverage for the entire lifetime of the policyholder, as long as premiums are paid.

- Premiums: Higher compared to term life insurance.

- Benefits: Includes a cash value component that grows over time.

- Best For: Individuals looking for lifelong coverage and a savings component.

Merits:

- Lifelong coverage.

- Cash value that can be borrowed against.

Demerits:

- Higher premium costs.

- Cash value growth may be slow.

3. Universal Life Insurance

- Definition: A flexible type of permanent life insurance that includes an investment component.

- Premiums: Can be adjusted based on the policyholder’s needs.

- Benefits: Offers flexibility in premium payments and death benefit amounts.

- Best For: People who want flexibility in their policy and investment options.

Merits:

- Flexible premiums.

- Cash value component.

Demerits:

- Complexity in managing the policy.

- Investment risk.

4. Variable Life Insurance

- Definition: Permanent life insurance with a cash value that is invested in various sub-accounts (like stocks and bonds).

- Premiums: Typically higher, with investment options available.

- Benefits: Cash value can grow based on investment performance.

- Best For: Individuals comfortable with investment risks seeking potential for higher returns.

Merits:

- Potential for high cash value growth.

- Investment choices.

Demerits:

- High risk due to market volatility.

- Complex to manage.

5. Endowment Life Insurance

- Definition: Pays out a lump sum after a specific term or upon death.

- Premiums: Higher than term life insurance due to the guaranteed payout.

- Benefits: Provides a maturity benefit if the policyholder survives the policy term.

- Best For: Individuals looking for a savings plan combined with life coverage.

Merits:

- Guaranteed payout.

- Acts as a savings tool.

Demerits:

- High premiums.

- Lower returns compared to other investments.

Merits of Life Insurance

- Financial Security: Provides peace of mind knowing dependents are protected.

- Tax Benefits: Premiums and payouts may have tax advantages.

- Wealth Creation: Permanent policies with cash value can grow wealth over time.

- Loan Facility: Cash value can be borrowed against in certain policies.

Demerits of Life Insurance

- Costly Premiums: Whole and universal life insurance can be expensive.

- Complex Terms: Some policies are difficult to understand and manage.

- Potential Loss: In some cases, if the policy is surrendered early, the cash value may be less than the premiums paid.

- Market Risk: Investment-linked policies (like variable life insurance) carry market risks.

Additional Topics Related to Life Insurance

1. How to Choose the Right Life Insurance Policy?

- Assess Needs: Determine the coverage amount needed based on family expenses and liabilities.

- Compare Policies: Look at different types of policies and their features.

- Check Insurer’s Reputation: Look for companies with good financial stability and customer service.

2. Life Insurance Riders

- Riders are add-ons to a policy for additional coverage.

- Examples:

- Accidental Death Rider: Additional payout if death occurs due to an accident.

- Critical Illness Rider: Lump sum payout on diagnosis of a serious illness.

- Waiver of Premium Rider: Waives premium payments if the policyholder becomes disabled.

3. Claim Settlement Process

- Notify the insurance company about the death.

- Submit the claim form along with the required documents (death certificate, policy document).

- The insurer reviews the claim and disburses the death benefit if all criteria are met.

Visual Representation of Life Insurance Types

Leave a Reply